Quick Answer

How do I pay off multiple credit cards efficiently? Follow this 4-step debt payoff system:

- List all cards — Write down each balance, interest rate, and minimum payment

- Choose your strategy — Avalanche (highest rate first) saves money; Snowball (lowest balance first) builds momentum

- Pay minimums everywhere — Then put ALL extra money toward your one target card

- Roll payments forward — When a card hits zero, add its payment to the next target

Bottom line: The average American carries 4 cards with $7,951 in total debt—this method can save thousands in interest and years of payments.

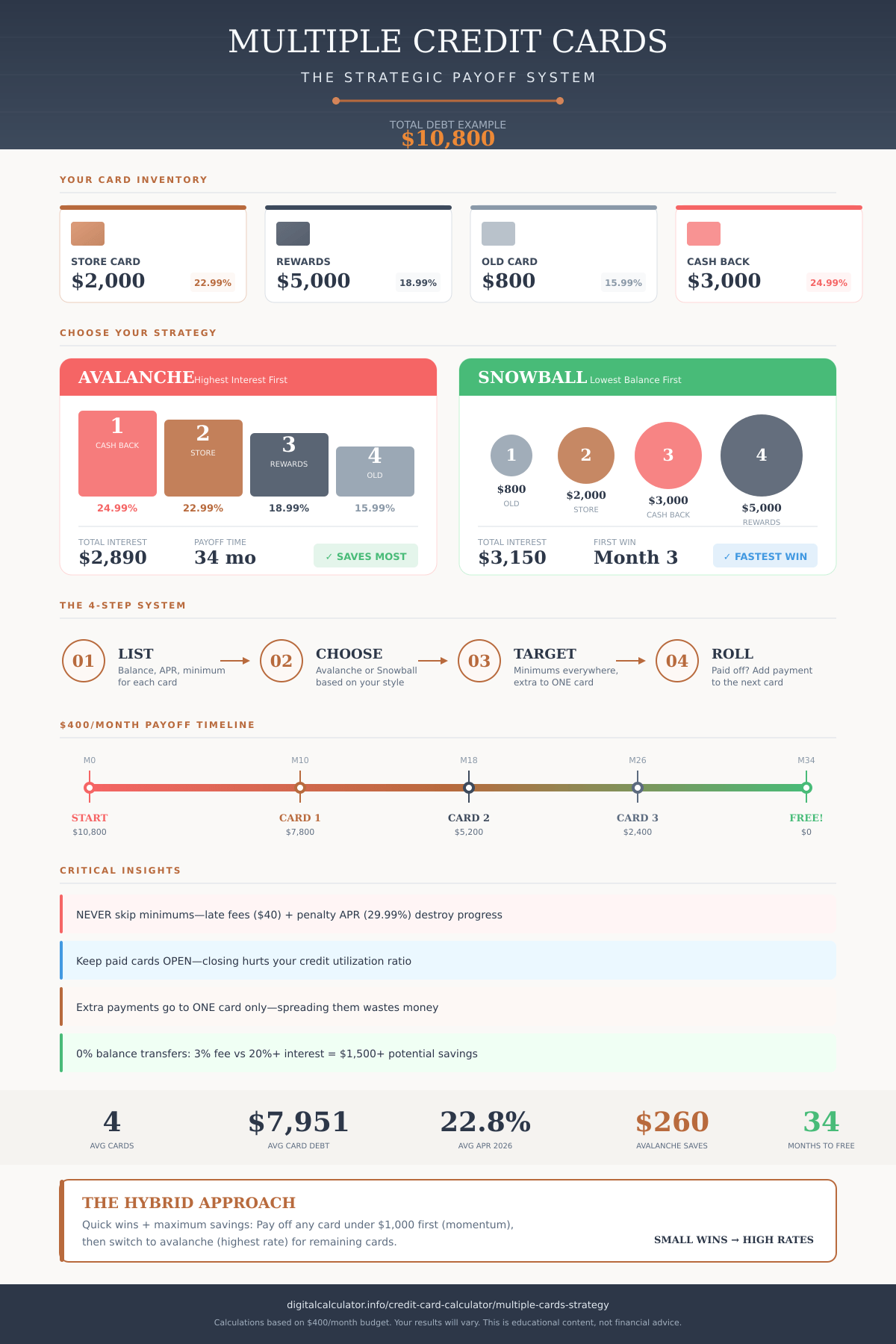

Calculate Your Multi-Card Payoff TimelineVisual Strategy Guide

See the complete debt payoff strategy at a glance. This infographic summarizes avalanche vs snowball methods, the 4-step system, and a real timeline for $10,800 in debt.

The Multiple Card Reality

If you're carrying balances on multiple credit cards, you're far from alone. The average American has nearly 4 credit cards, and total U.S. credit card debt has surpassed $1.17 trillion. Multiple cards happen for many reasons--store cards offering discounts, balance transfers, different rewards programs, or simply life happening faster than your income.

The real danger isn't having multiple cards--it's not having a strategy for paying them off. When you're making minimum payments on four different cards, here's what's happening:

- Interest compounds on each card separately--you're fighting multiple battles

- Minimum payments barely dent principal--most goes to interest

- Progress feels invisible--all balances drop slowly

- Motivation crashes--leading to giving up or adding more debt

Multiple cards don't mean you're bad with money. Medical expenses, job loss, education, or helping family can all lead to card debt. What matters now is your plan forward.

Step 1: Take Inventory of Your Debt

Before choosing a strategy, you need the full picture. Gather this information for each card:

- Current balance--not credit limit, actual amount owed

- Annual Percentage Rate (APR)--the interest rate charged

- Minimum payment--the least you must pay monthly

- Credit limit--useful for utilization calculations

Sample Debt Inventory

| Card | Balance | APR | Minimum | Limit |

|---|---|---|---|---|

| Store Card | $2,000 | 22.99% | $50 | $3,000 |

| Rewards Card | $5,000 | 18.99% | $100 | $8,000 |

| Old Card | $800 | 15.99% | $25 | $2,500 |

| Cash Back Card | $3,000 | 24.99% | $75 | $5,000 |

| Total | $10,800 | -- | $250 | $18,500 |

This inventory reveals two critical numbers: your total debt ($10,800) and your total minimum payments ($250). Any amount you can pay above $250/month becomes your debt-crushing power.

Avalanche vs Snowball: Which Strategy for Multiple Cards?

With multiple cards, the order you attack them matters enormously. Two strategies dominate the debt payoff world, and both work--but they optimize for different things. For a deeper comparison with interactive examples, see our avalanche vs snowball guide.

The Debt Avalanche Method

How it works: Pay minimums on all cards. Put every extra dollar toward the card with the highest interest rate. When it's paid off, move to the next highest rate.

Mathematical advantage: This method minimizes total interest paid. You're attacking the debt that's growing fastest first.

Best for: People motivated by numbers, those with patience, and situations where rate differences are significant.

Using the table above, you'd pay the Cash Back Card (24.99%) first, then Store Card (22.99%), then Rewards Card (18.99%), then Old Card (15.99%).

The Debt Snowball Method

How it works: Pay minimums on all cards. Put every extra dollar toward the card with the lowest balance. When it's paid off, move to the next lowest balance.

Psychological advantage: You see wins faster. Eliminating a card completely--no matter the size--creates motivation to keep going.

Best for: People who need quick wins, those who've struggled to stick with debt payoff before, and situations with small balances that can be eliminated quickly.

Using the table above, you'd pay the Old Card ($800) first, then Store Card ($2,000), then Cash Back Card ($3,000), then Rewards Card ($5,000).

Head-to-Head Comparison

Let's compare both methods using our $10,800 example with a $400/month budget:

| Factor | Avalanche | Snowball |

|---|---|---|

| Total interest paid | $2,890 | $3,150 |

| Time to debt-free | 34 months | 35 months |

| First card paid off | Month 10 | Month 3 |

| Interest savings | $260 more | -- |

The avalanche saves $260 in this example--real money. But the snowball gets you a win 7 months earlier. Which matters more to you?

The best debt payoff method is the one you'll actually stick with. Saving $260 means nothing if frustration causes you to give up at month 8.

The Hybrid Strategy: Best of Both Worlds

What if you could get quick wins AND optimize for interest? Enter the hybrid approach.

How it works:

- Identify any cards you could pay off in 1-3 months--knock those out first regardless of rate

- Then switch to avalanche (highest rate first) for remaining cards

Using our example:

- First: Old Card ($800, 15.99%) -- paid off in 2 months with $150 extra

- Then Avalanche: Cash Back (24.99%) then Store Card (22.99%) then Rewards (18.99%)

You get the motivational boost of eliminating a card quickly, then maximize interest savings on the larger balances.

If you have a card within $200-300 of your extra monthly payment, consider the hybrid approach. That quick win can power you through the longer haul ahead.

Real Scenarios: 4-Card Payoff Examples

Scenario 1: The Mixed Bag

Sarah has 4 cards with different balances and rates. Her budget allows $400/month total.

| Card | Balance | APR | Avalanche Order | Snowball Order |

|---|---|---|---|---|

| Card A | $2,000 | 22.99% | 2nd | 2nd |

| Card B | $5,000 | 18.99% | 4th | 4th |

| Card C | $800 | 15.99% | 3rd | 1st |

| Card D | $3,000 | 24.99% | 1st | 3rd |

Best strategy: Hybrid--knock out Card C ($800) in 2 months for a quick win, then switch to avalanche and attack Card D (24.99% APR) next.

Scenario 2: One Big Card Dominating

Marcus has one massive balance alongside smaller cards. Monthly budget: $500.

| Card | Balance | APR |

|---|---|---|

| Big Card | $12,000 | 19.99% |

| Card A | $1,500 | 22.99% |

| Card B | $800 | 17.99% |

| Card C | $2,000 | 21.99% |

Best strategy: Snowball the three smaller cards first (B then A then C). Psychologically, eliminating 3 cards keeps momentum high. The big card is actually the lowest rate, so you're not losing much mathematically--and you'll free up $113 in minimum payments to throw at the big card.

Scenario 3: Similar Balances, Different Rates

Diana has 4 cards all around $2,500 but with very different rates. Monthly budget: $400.

| Card | Balance | APR |

|---|---|---|

| Card A | $2,500 | 26.99% |

| Card B | $2,400 | 22.99% |

| Card C | $2,600 | 18.99% |

| Card D | $2,500 | 15.99% |

Best strategy: Pure avalanche (A then B then C then D). When balances are similar, rate differences matter most. The 11-point spread between Card A (26.99%) and Card D (15.99%) will save Diana over $500 in interest compared to a random payoff order.

Balance Transfers with Multiple Cards

A 0% APR balance transfer can supercharge your payoff--but the math gets trickier with multiple cards.

When Transfers Make Sense

- Your highest-rate card has a significant balance ($3,000+)

- You can pay off the transferred amount within the 0% period

- The transfer fee (typically 3-5%) is less than interest you'd pay

- You won't be tempted to run up the old card again

Transfer Fee Math

Let's say you transfer $5,000 at 22% APR to a card with 3% fee and 18-month 0% period:

- Transfer fee: $5,000 x 3% = $150

- Interest saved (18 months): ~$1,650

- Net savings: ~$1,500

If you don't pay off the balance before the promotional period ends, some cards charge deferred interest on the ORIGINAL balance--not just what's left. Read the fine print carefully.

Partial Transfer Strategy

With multiple high-rate cards, you might not qualify to transfer everything. Prioritize transferring your highest-rate balance first. Leave lower-rate balances where they are and attack them with your avalanche/snowball strategy.

What If You Can Only Pay Minimums?

Sometimes life limits your options. If minimums are all you can manage right now, here's your survival plan:

Emergency Triage Mode

- Pay all minimums on time--late fees ($29-40) and penalty APRs (up to 29.99%) will make things worse

- Prioritize cards approaching limits--maxing out tanks your credit score

- Call your issuers--request hardship programs, lower rates, or temporary payment plans

- Find even $20 extra--any amount above minimums helps. Check our take-home pay guide for ideas on maximizing your available cash

Signs You Need Professional Help

- Minimum payments exceed 10% of your take-home pay

- You're using one card to pay another

- Creditors are calling

- You're considering bankruptcy

Nonprofit credit counseling agencies can negotiate with creditors and create debt management plans. The National Foundation for Credit Counseling (opens in new tab) can connect you with a legitimate agency.

Tracking Your Multi-Card Progress

With multiple cards, progress can feel invisible unless you track it intentionally.

Simple Spreadsheet Method

Create a monthly tracker with columns for each card's balance. Update it on the same day each month (like the 1st). Watching numbers decrease--and seeing the total drop--provides concrete motivation.

Visual Progress Tracking

- Debt thermometer--color in as you pay down

- Card countdown--cross off cards as you eliminate them

- Percentage tracker--"60% of my debt is GONE"

Celebrate Milestones

Debt payoff is a marathon. Celebrate:

- Every card paid off (no matter how small)

- Passing 25%, 50%, 75% paid

- Reaching single-digit thousands

- Final payment day

Celebrations don't have to cost money--a special meal at home, a day off from side hustles, or simply telling someone you trust about your progress.

Avoiding the Debt Cycle

Paying off cards is half the battle. Staying out of debt is the other half.

Why People End Up with Multiple Cards

- Store discounts ("Save 20% with our card!")

- Balance transfer chasing without payoff plan

- Emergency expenses without emergency fund

- Lifestyle creep outpacing income

Building an Emergency Fund While in Debt

Controversial advice: start a small emergency fund ($500-$1,000) even while paying off debt. Why? Without cash reserves, any surprise sends you back to cards. This mini-fund breaks the cycle. Our emergency fund guide can help you figure out the right target for your situation.

When to Close Paid-Off Cards

Closing cards reduces available credit, increases your credit utilization ratio, and shortens credit history--all bad for your score. Exception: close cards with annual fees you can't justify or if the temptation to overspend is too strong.

Frequently Asked Questions

Should I close credit cards as I pay them off?

Generally, no. Closing cards reduces your available credit, which can increase your credit utilization ratio and hurt your score. Keep paid-off cards open but unused, unless they have an annual fee you can't justify or you're tempted to overspend.

How do I handle a card with a promotional 0% APR?

Pay minimum on the 0% card while aggressively paying down high-interest cards. Then, before the promotional period ends, make sure you can pay off the 0% balance completely or have a plan to transfer it again--because deferred interest can be charged on the original balance.

Should I use savings to pay off credit card debt?

It depends. Keep at least $1,000-$2,000 in emergency savings to avoid going back into debt. Beyond that, paying off 20%+ APR debt is essentially earning a guaranteed 20% return, which beats any savings account. Balance security with debt payoff. Use our best savings rates guide to find the highest-yield account for your emergency fund.

What's better: extra payment to one card or split across all?

Always focus extra payments on ONE card while paying minimums on others. Splitting extra money across all cards means you're paying more interest overall and seeing slower progress on each card. Pick your target card based on avalanche (highest rate) or snowball (lowest balance) method.

Can I negotiate lower interest rates on my cards?

Yes, and it works more often than people think. Call your card issuer, mention you're a long-time customer with good payment history, and ask for a rate reduction. Success rates are around 70% for customers who ask. Even a few percentage points can save hundreds in interest.

Your Multi-Card Payoff Action Plan

Step 1: Complete Your Debt Inventory

List every card with balance, APR, and minimum payment. Calculate your total.

Step 2: Choose Your Strategy

Pick avalanche (math-optimal), snowball (motivation-optimal), or hybrid (best of both).

Step 3: Set Up Automatic Minimums

Never miss a payment. Automate minimums on all cards.

Step 4: Direct All Extra to Your Target Card

Every dollar above minimums goes to ONE card--your current target.

Step 5: Track Progress Monthly

Update your spreadsheet. Celebrate milestones. Adjust if needed.

Ready to Calculate Your Exact Payoff Date?

Use our credit card calculator to see exactly how long your multi-card payoff will take, how much interest you'll pay, and how extra payments accelerate your freedom.

See How Long to Pay Off Your Credit Card →