Quick Answer

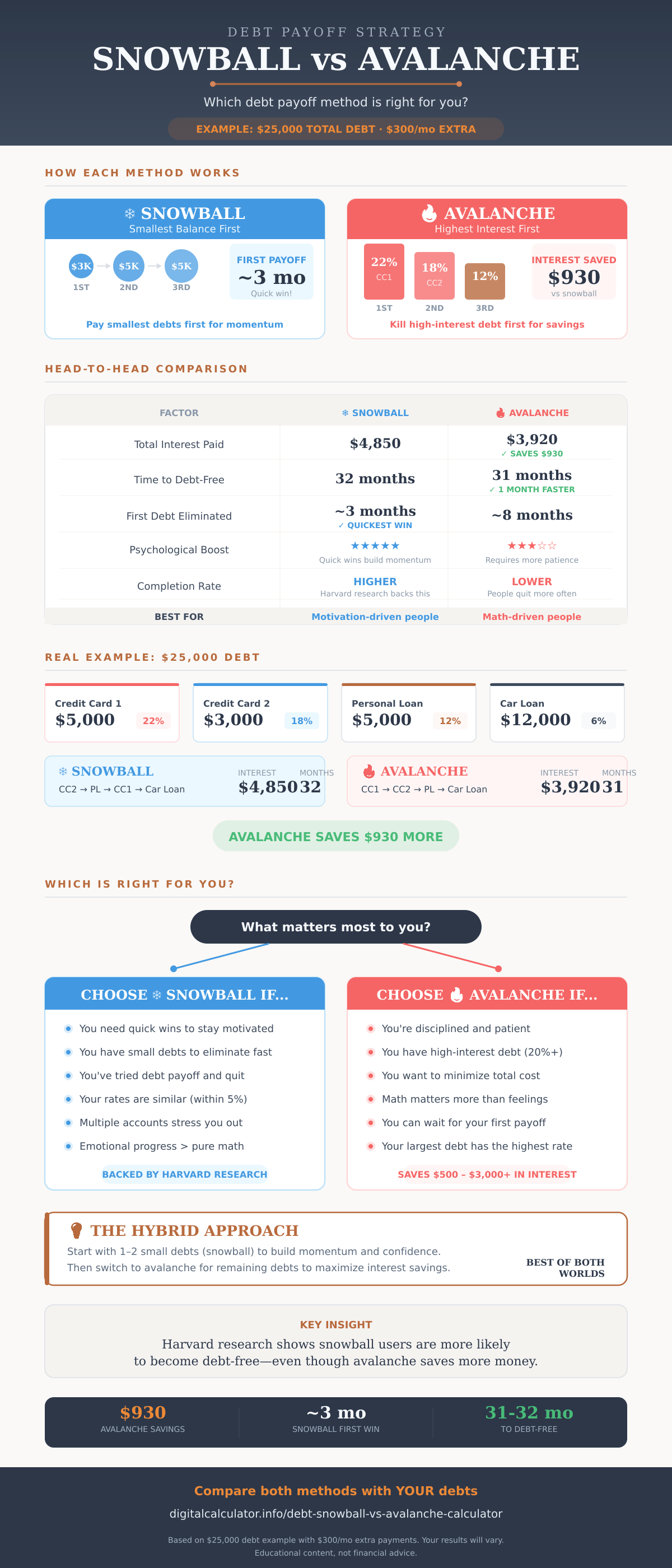

Which is better? The debt avalanche saves more money (typically $500-$3,000+) by targeting high-interest debt first. The debt snowball provides quicker wins by eliminating small debts first, which helps people stay motivated.

Key insight: Harvard research shows people using the snowball method are more likely to become debt-free because quick wins drive persistence - even though avalanche saves more money mathematically.

Compare Both Methods with Your DebtsVisual Comparison Guide

See the complete comparison at a glance. This infographic summarizes both methods, shows real savings calculations, and helps you decide which approach fits your situation.

Understanding the Two Methods

The Debt Snowball Method

The debt snowball, popularized by financial expert Dave Ramsey, focuses on paying off your smallest balance first, regardless of interest rate.

How it works:

- List all debts from smallest balance to largest

- Pay minimums on all debts except the smallest

- Put all extra money toward the smallest debt

- Once paid off, "snowball" that payment to the next smallest

- Repeat until debt-free

The psychology: You might pay off your first debt in 2-3 months, giving you a win that motivates continued effort. Each eliminated debt feels like progress.

The Debt Avalanche Method

The debt avalanche prioritizes mathematical efficiency by targeting the highest interest rate first.

How it works:

- List all debts from highest APR to lowest

- Pay minimums on all debts except the highest-rate debt

- Put all extra money toward the highest-interest debt

- Once paid off, move to the next highest rate

- Repeat until debt-free

The math: By eliminating high-interest debt first (often credit cards at 20-25% APR), you stop the most expensive interest from compounding. This approach minimizes total interest paid.

Head-to-Head Comparison

| Factor | Debt Snowball | Debt Avalanche |

|---|---|---|

| Order of payoff | Smallest balance first | Highest interest first |

| Total interest paid | Higher | Lower (optimal) |

| Time to first payoff | Usually faster | May take longer |

| Total time to debt-free | Usually longer | Usually shorter |

| Psychological benefit | Quick wins, momentum | Requires more patience |

| Best for | Motivation-driven people | Math-driven people |

| Recommended by | Dave Ramsey | Most financial mathematicians |

Real Examples: How Much Can You Save?

Let's compare both methods with real debt scenarios to see the actual dollar difference.

Example 1: Typical American Debt ($25,000)

| Debt | Balance | APR | Min Payment |

|---|---|---|---|

| Credit Card 1 | $5,000 | 22% | $150 |

| Credit Card 2 | $3,000 | 18% | $90 |

| Car Loan | $12,000 | 6% | $250 |

| Personal Loan | $5,000 | 12% | $150 |

Extra monthly payment: $300

Snowball order: Credit Card 2 ($3k) > Personal Loan ($5k) > Credit Card 1 ($5k) > Car Loan ($12k)

Avalanche order: Credit Card 1 (22%) > Credit Card 2 (18%) > Personal Loan (12%) > Car Loan (6%)

| Method | Total Interest | Time to Debt-Free | Savings |

|---|---|---|---|

| Snowball | $4,850 | 32 months | - |

| Avalanche | $3,920 | 31 months | $930 saved |

Example 2: Credit Card Heavy ($15,000)

| Debt | Balance | APR | Min Payment |

|---|---|---|---|

| Store Card | $2,000 | 28% | $60 |

| Visa | $8,000 | 22% | $200 |

| Mastercard | $5,000 | 16% | $125 |

Extra monthly payment: $250

| Method | Total Interest | Time to Debt-Free | Savings |

|---|---|---|---|

| Snowball | $4,200 | 28 months | - |

| Avalanche | $3,400 | 27 months | $800 saved |

Example 3: When It Doesn't Matter Much ($20,000)

When interest rates are similar, the methods produce nearly identical results:

| Debt | Balance | APR |

|---|---|---|

| Loan A | $7,000 | 9% |

| Loan B | $6,500 | 8% |

| Loan C | $6,500 | 10% |

| Method | Total Interest | Time | Difference |

|---|---|---|---|

| Snowball | $2,750 | 34 months | - |

| Avalanche | $2,680 | 34 months | $70 |

When rates are within 2-3% of each other: The savings difference is minimal. Choose whichever method motivates you more - the "best" strategy is the one you'll actually stick with.

The Psychology Behind Debt Payoff

Here's where it gets interesting: the mathematically optimal choice isn't always the best choice for you.

Harvard Business Review Research

A 2016 study published in Harvard Business Review found that people who focused on reducing the number of accounts (the snowball approach) were more likely to eliminate all their debt than those who focused on reducing the total balance.

Why? Quick wins create momentum. Paying off that first $500 credit card in 2 months feels like real progress. It proves you can do this. It builds confidence. And as you close accounts, your credit utilization ratio may improve, boosting your credit score along the way.

The "Debt Fatigue" Problem

With the avalanche method, you might spend 8-12 months paying down a large, high-interest balance before crossing anything off your list. For many people, this feels like running on a treadmill going nowhere.

Debt fatigue leads to:

- Giving up on the plan entirely

- Rewarding yourself by spending (undoing progress)

- Losing motivation to find extra money for payments

The real cost of giving up: If avalanche saves $1,000 but you quit after 6 months, you've saved nothing. A snowball approach you complete beats an avalanche approach you abandon.

Behavioral Economics Perspective

Several psychological factors favor the snowball method:

- Loss aversion: We feel losses more strongly than gains - eliminating a debt feels like removing a burden

- Progress tracking: Crossing items off a list is inherently satisfying

- Simplification: Fewer accounts to manage reduces mental load

- Commitment devices: Early success strengthens commitment to the plan

Which Method Is Right for You?

Choose Snowball If...

- You need quick wins to stay motivated

- You have multiple small debts that can be eliminated quickly

- You've tried debt payoff before and given up

- You value emotional progress over pure math

- Your interest rates are relatively similar (within 5%)

- You find managing multiple accounts stressful

Choose Avalanche If...

- You're disciplined and patient

- You have significant high-interest debt (20%+ credit cards)

- You want to minimize total cost no matter what

- Math matters more to you than feelings

- You can stay motivated without quick wins

- Your largest debt also has the highest interest rate

The Hybrid Approach: Best of Both Worlds

You don't have to choose just one method. Consider this hybrid strategy:

- Start with 1-2 small debts (snowball) - Get quick wins and build confidence

- Switch to avalanche for the rest - Once motivated, optimize for savings

This approach gives you the psychological boost of early wins while still minimizing interest on larger debts.

Pro tip: If your smallest debt also happens to have a high interest rate, you get the best of both worlds. Pay it first with enthusiasm.

Step-by-Step: How to Start Today

- List all your debts - Include balance, interest rate, and minimum payment for each

- Calculate your extra payment amount - Review your budget to find money beyond minimums (even $50 helps)

- Choose your method - Based on the decision framework above

- Set up automatic payments - Automate minimums on all debts, plus extra to your target debt

- Track progress monthly - Use our calculator to see your updated timeline

- Celebrate milestones - When you pay off a debt, acknowledge the win (but don't spend the savings)

Common Mistakes to Avoid

- No emergency fund: Before aggressive debt payoff, save $1,000-$2,000 for emergencies. Without this buffer, unexpected expenses force you back into debt.

- Taking on new debt: Don't use credit cards while paying off existing balances. Hide them, cut them up, or freeze them in ice.

- Missing minimum payments: Always pay minimums on ALL debts. Late payments damage credit and incur fees.

- Lifestyle inflation: When you pay off a debt, roll that payment to the next debt - don't upgrade your lifestyle.

- Giving up too early: Debt payoff takes time. The average American with $25,000 in debt needs 2-3 years to become debt-free. Plan for a marathon, not a sprint.

- Not celebrating wins: Acknowledge progress. Each paid-off debt deserves recognition (just not expensive celebration).

Beyond Snowball and Avalanche

The Debt Tsunami Method

Pay debts based on emotional weight rather than balance or interest rate. Which debt causes you the most stress? Pay that first.

Examples of emotionally heavy debts:

- Money owed to family or friends

- Debts from a past relationship

- Medical debt with collection agencies calling

- Debts tied to regretted purchases

Consolidation vs. Payoff Methods

When consolidation might make sense:

- You can get a significantly lower interest rate (5%+ reduction)

- You have good credit and qualify for a 0% balance transfer

- You need simplified payments (one payment vs. many)

Risks of consolidation:

- Balance transfer fees (typically 3-5%)

- Temptation to use cleared credit cards again

- May extend your payoff timeline

- Introductory rates expire (and spike)

Frequently Asked Questions

What is the difference between debt snowball and avalanche?

The debt snowball pays off debts from smallest balance to largest, regardless of interest rate. The debt avalanche pays off debts from highest interest rate to lowest. Both require making minimum payments on all debts while putting extra money toward one target debt. Snowball provides quicker wins; avalanche saves more money in interest.

Which method saves the most money?

The debt avalanche method almost always saves more money because it eliminates high-interest debt first, stopping the most expensive interest from accruing. Depending on your debt profile, the avalanche can save $500 to $3,000 or more compared to the snowball method.

Can I switch between methods mid-way?

Yes, you can switch methods at any time. Many people start with snowball to get quick wins and build momentum, then switch to avalanche once they're motivated. The key is consistency with extra payments - the method matters less than sticking with your plan.

Should I include my mortgage?

Most experts recommend excluding mortgages from debt payoff strategies. Focus on consumer debt like credit cards, car loans, and personal loans first. Mortgages are long-term, typically lower-interest, and secured by your home - they're treated differently than consumer debt.

What if I can only afford minimum payments?

If you can only make minimum payments, neither snowball nor avalanche will help much - both require extra payments to accelerate debt payoff. Focus on increasing income or reducing expenses to free up even $50-100 monthly for debt payoff. Small amounts make a big difference over time.

How long does it take to become debt-free?

The timeline depends on your total debt, interest rates, and extra payment amount. With $25,000 in debt and $300 extra monthly, you could be debt-free in 2.5-3 years using either method. Use our calculator to see your specific timeline based on your actual debts.

Compare Both Methods with Your Debts

Enter your actual debts to see exactly how much you could save with each payoff strategy.

Try Debt Payoff Calculator